ESG Integration and its Impact#

Exploring ESG Integration and its Impact on Organizational Performance and Sustainability through Scientometric Analysis

Abstract#

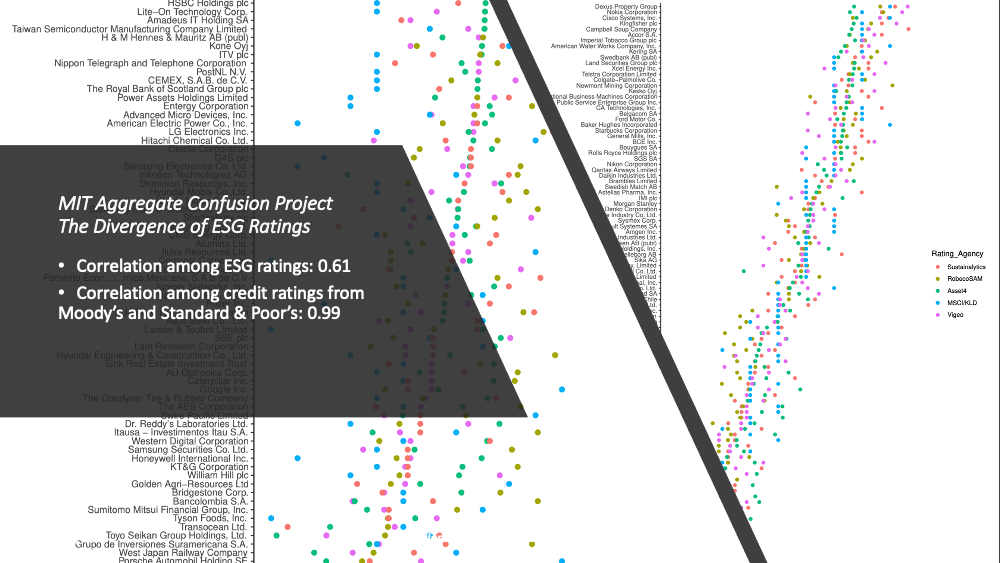

Environmental, Social, and Governance (ESG) integration has gained significant attention in recent years, as investors and organizations strive to incorporate these factors into their investment and decision-making processes. Despite its prominence, barriers to full ESG integration persist, including the lack of understanding of the link between a firm’s environmental performance and its financial performance. This article explores ESG research through scientometric analysis, examining the literature and identifying the missing links that could potentially bridge the gaps in understanding ESG integration, organizational performance, and sustainability.

Introduction#

ESG integration is defined by the United Nations Principles for Responsible Investment (UNPRI) as the explicit and systematic inclusion of ESG issues in investment analysis and investment decisions. However, there are several barriers to ESG data mobilization and integration, such as the difficulty in establishing universally agreed criteria of ESG evaluation, the need for more robust tools to evaluate ESG data, and the ineffective use of new data collection and analytics tools by investors.

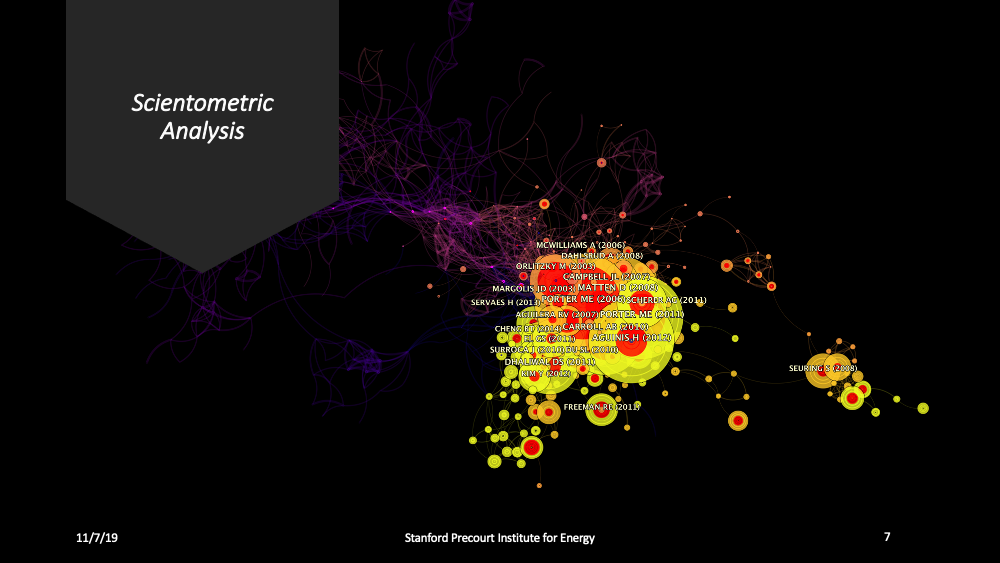

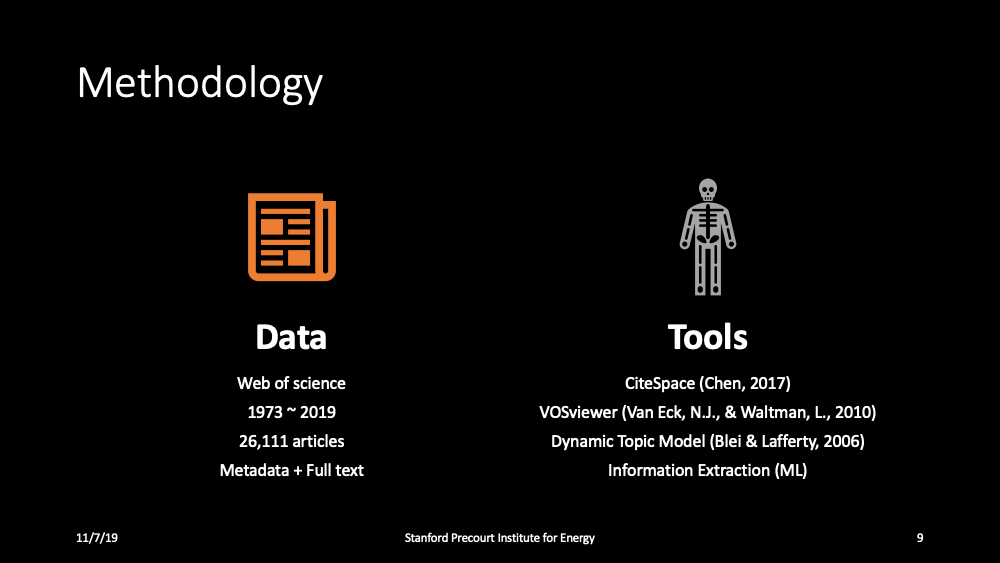

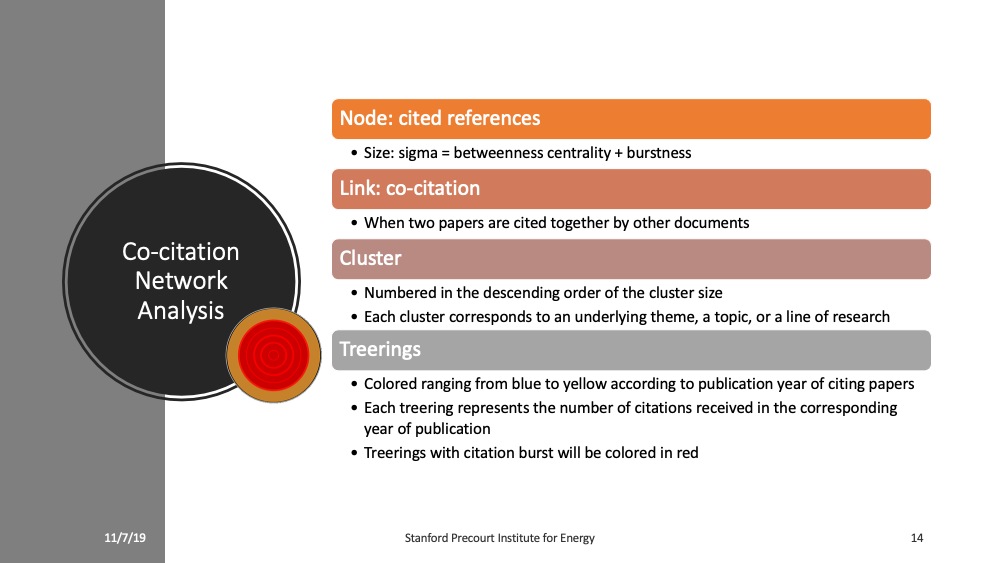

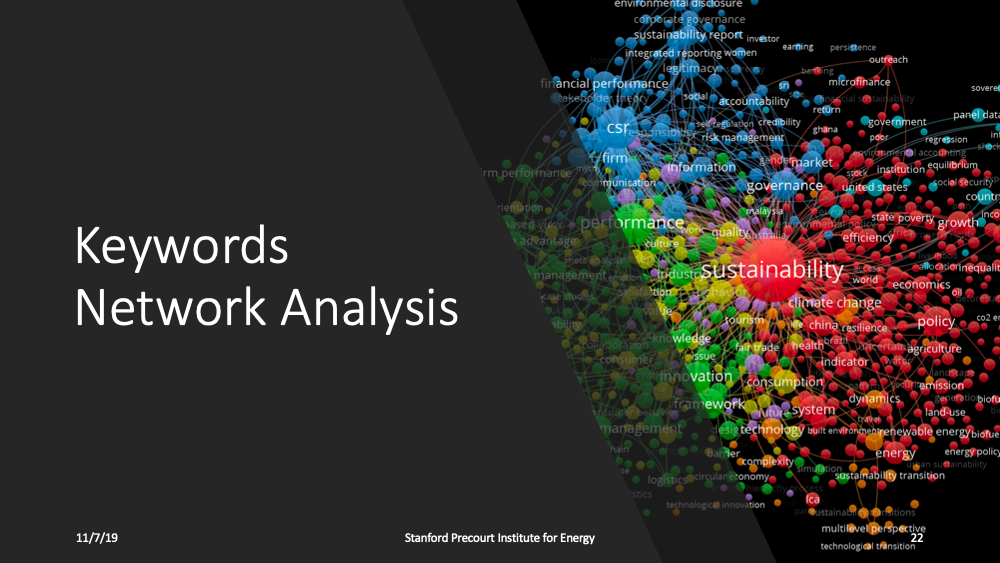

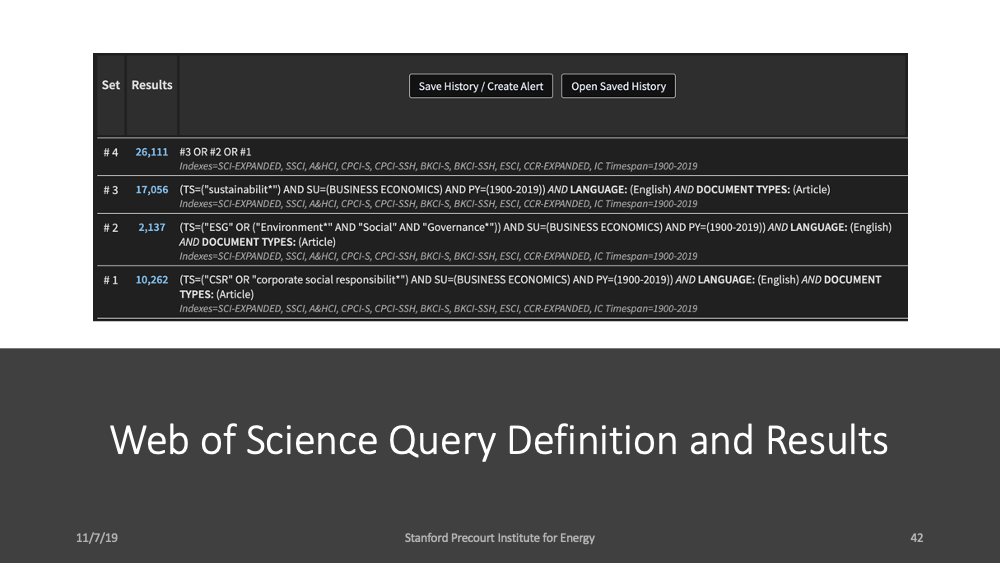

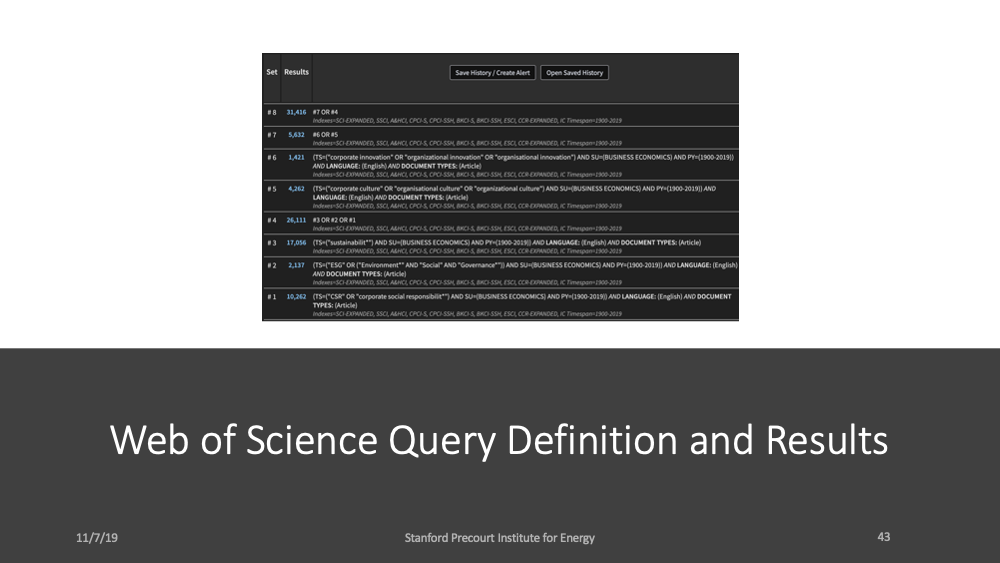

Scientometric analysis, which includes methods such as citation analysis, social network analysis, co-word and content analysis, and text mining, can be employed to measure the evolution of a scientific domain, the impact of scholarly publications, and the patterns of authorship and knowledge production in ESG research.

Research Agenda#

The scientometric analysis of ESG research was conducted with the following objectives:

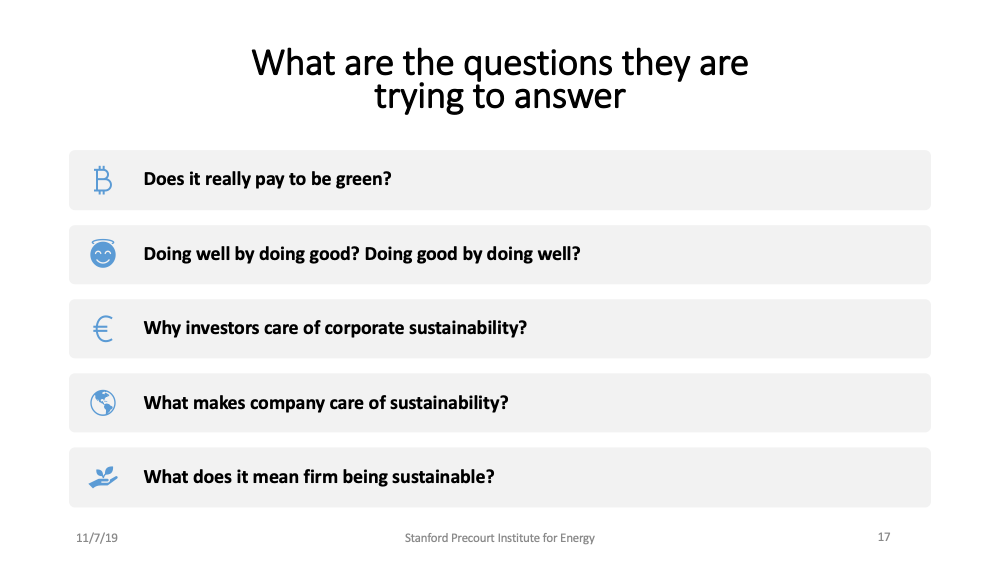

To define ESG in literature, examining the history and trends of ESG research and identifying the research topics.

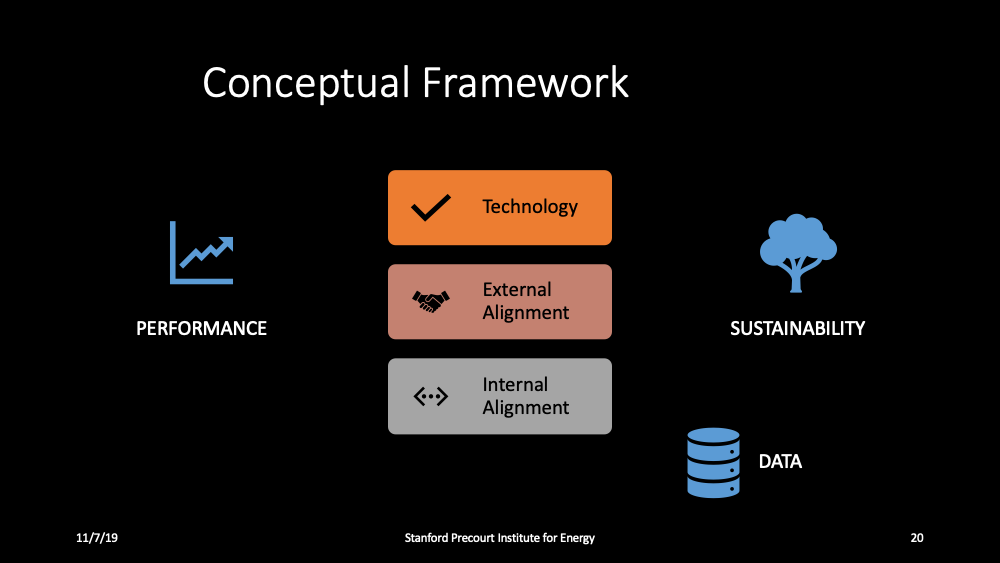

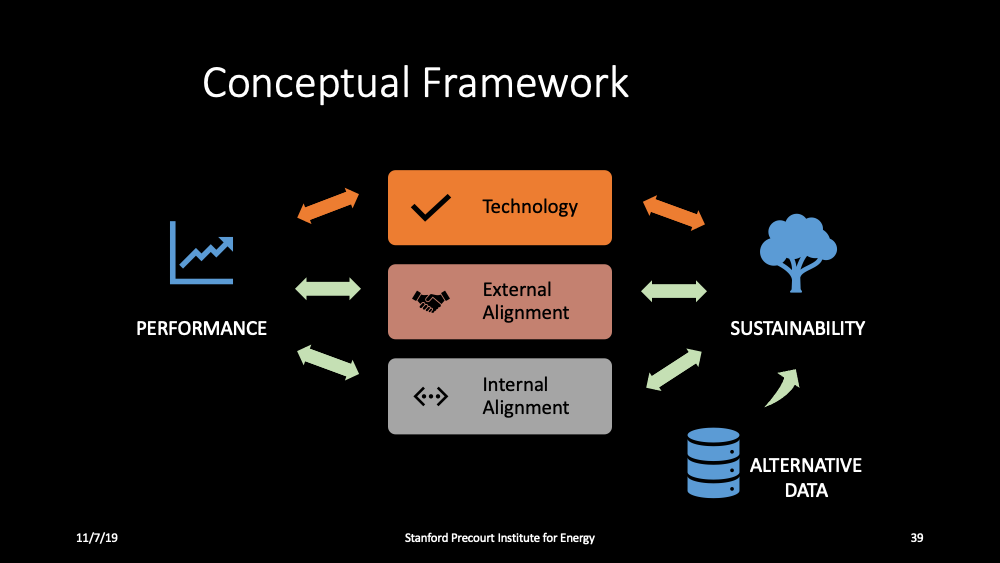

To explore the relationship among ESG, sustainability, and performance in literature, determining what is explained and what is not.

To identify the missing links and potential areas of research and data sources that could bridge the gaps in understanding ESG integration and its impact on organizational performance and sustainability.

Findings#

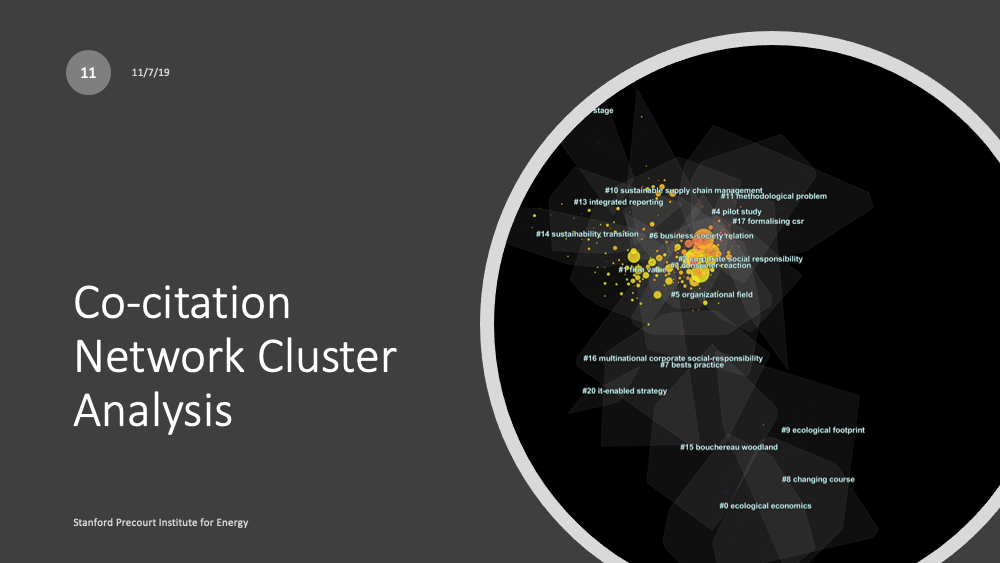

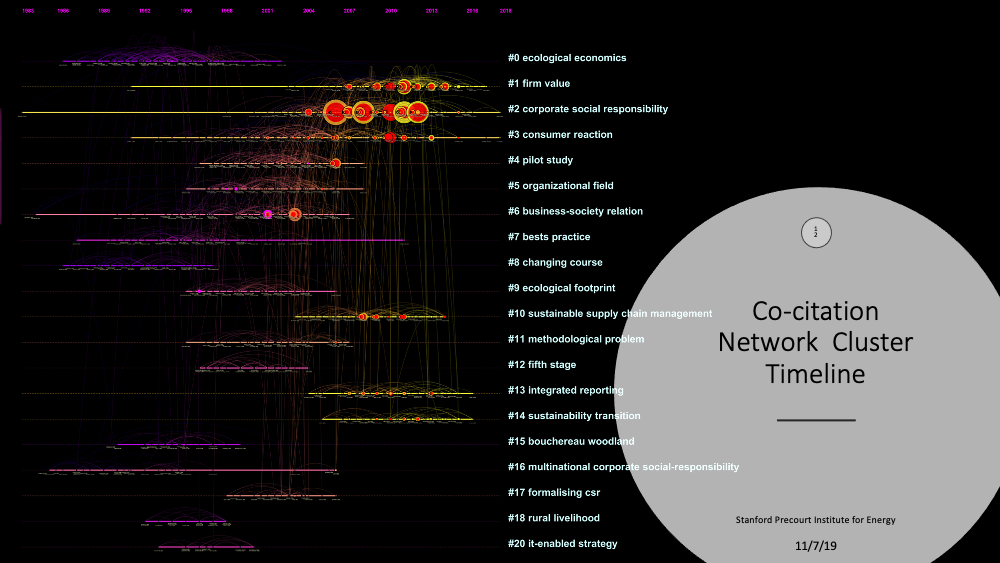

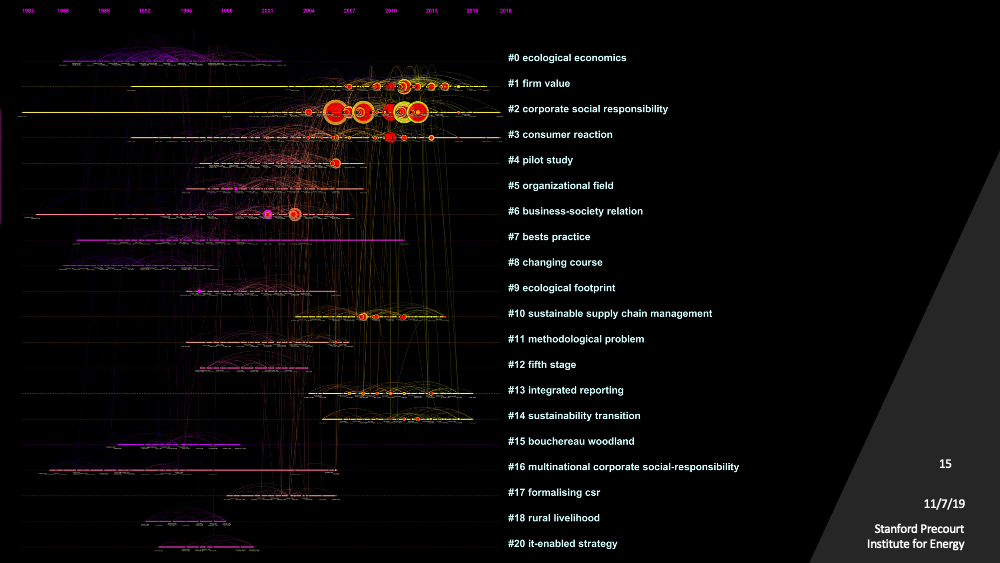

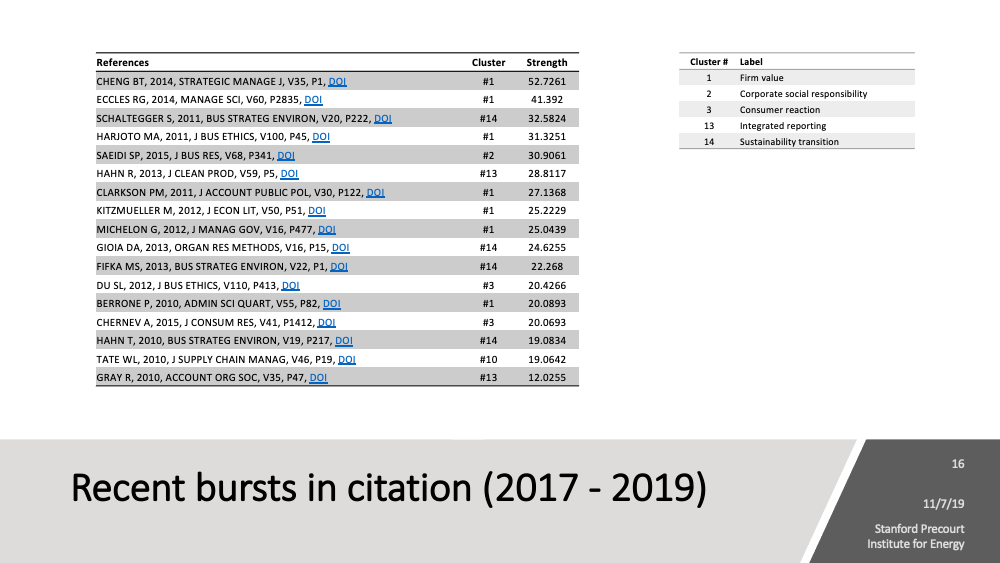

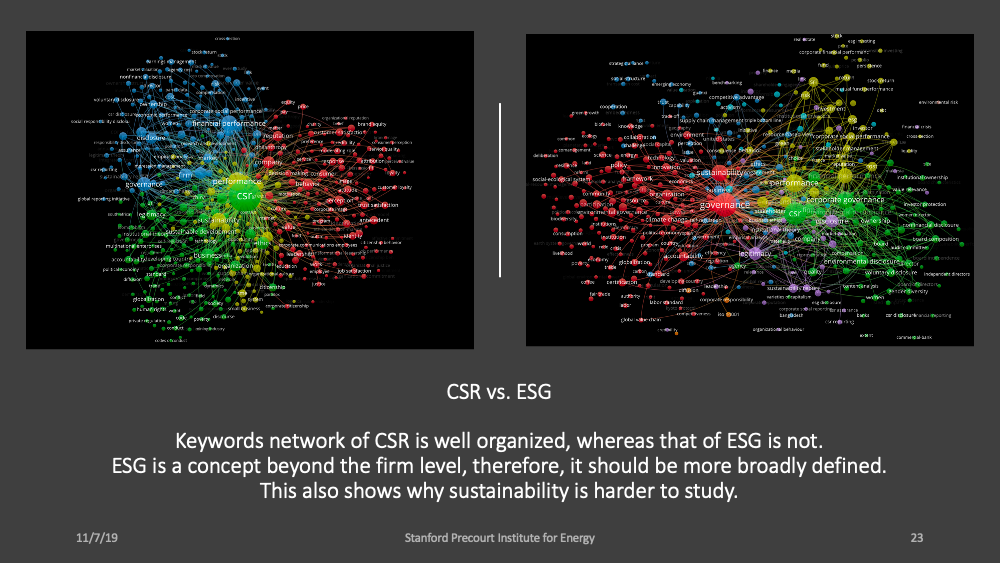

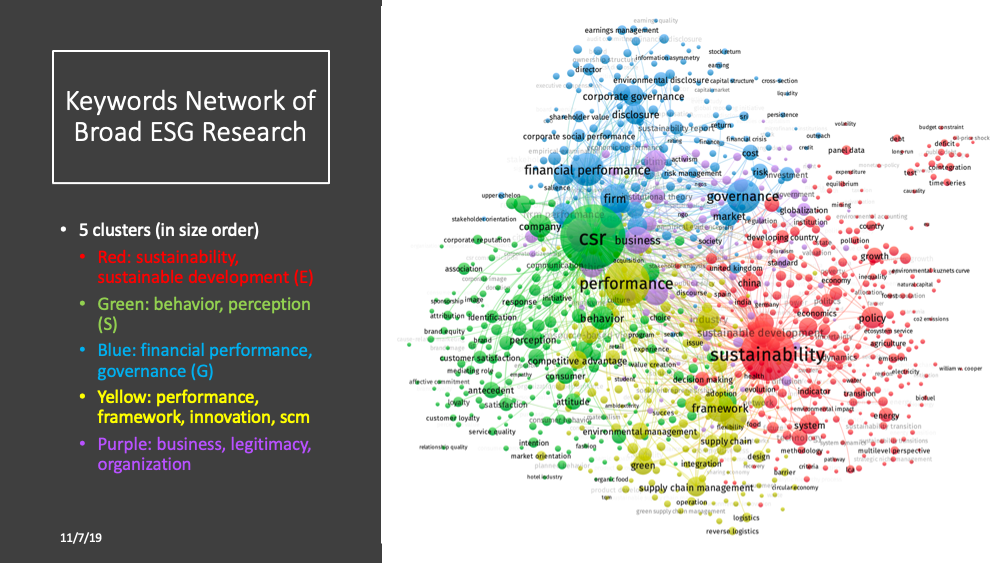

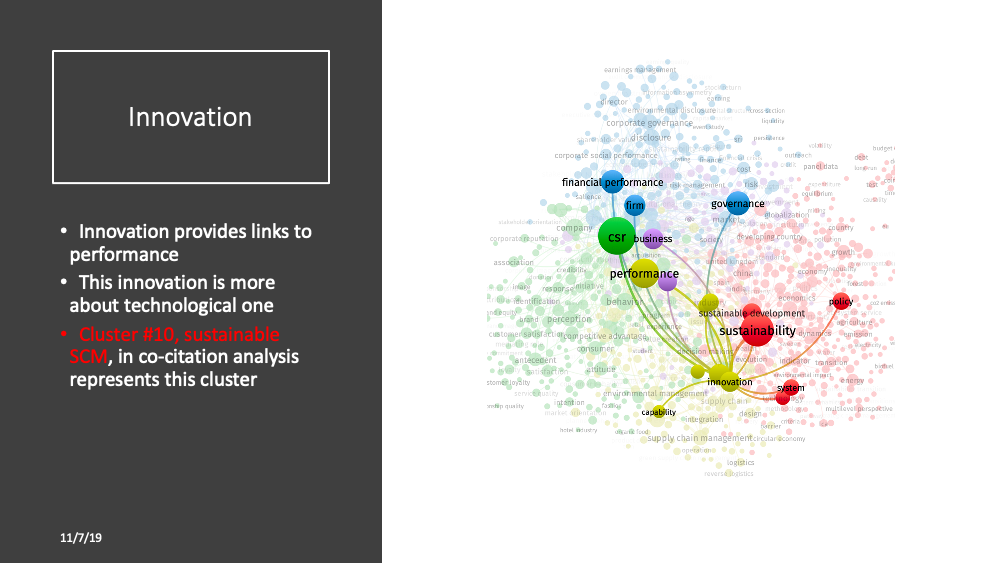

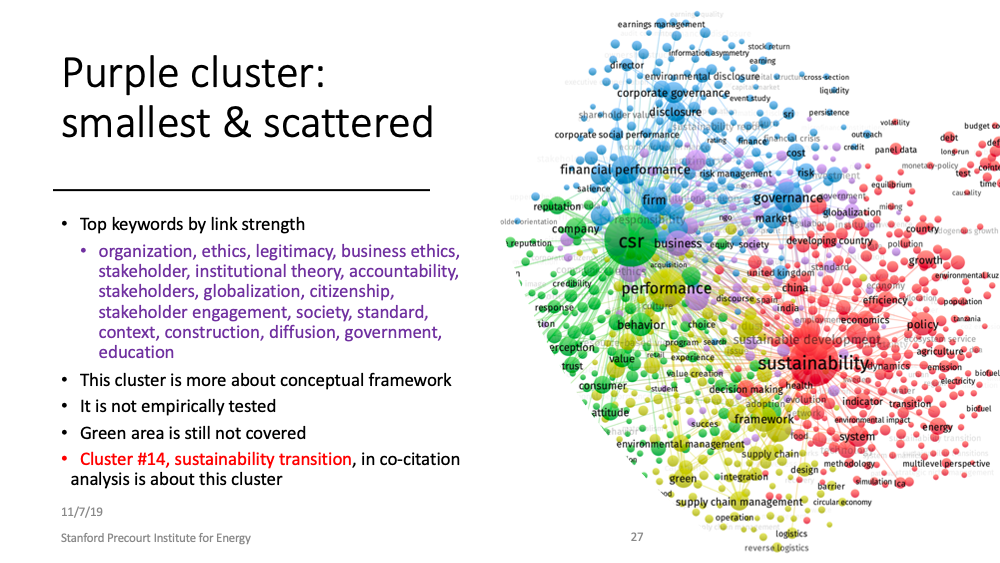

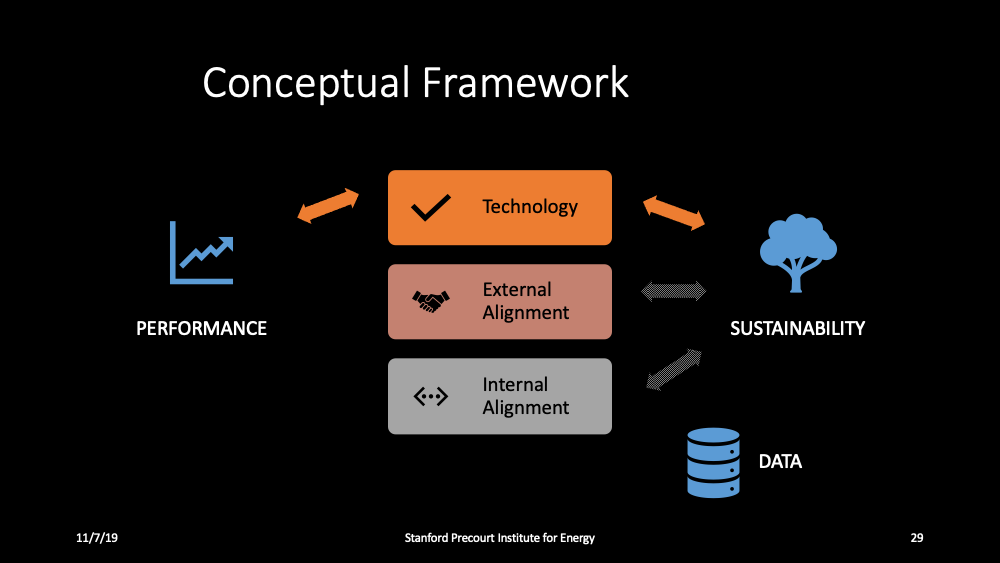

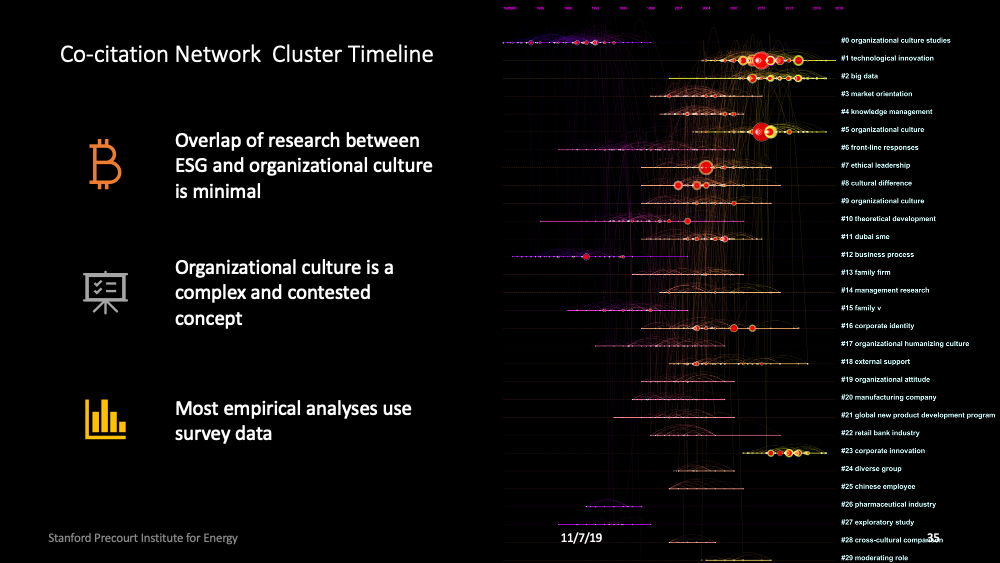

The analysis revealed that the literature on ESG is fragmented, with significant gaps in understanding the relationship between ESG factors, organizational performance, and sustainability. The co-citation network cluster analysis identified several research clusters, including firm value, corporate social responsibility, consumer reaction, integrated reporting, and sustainability transition.

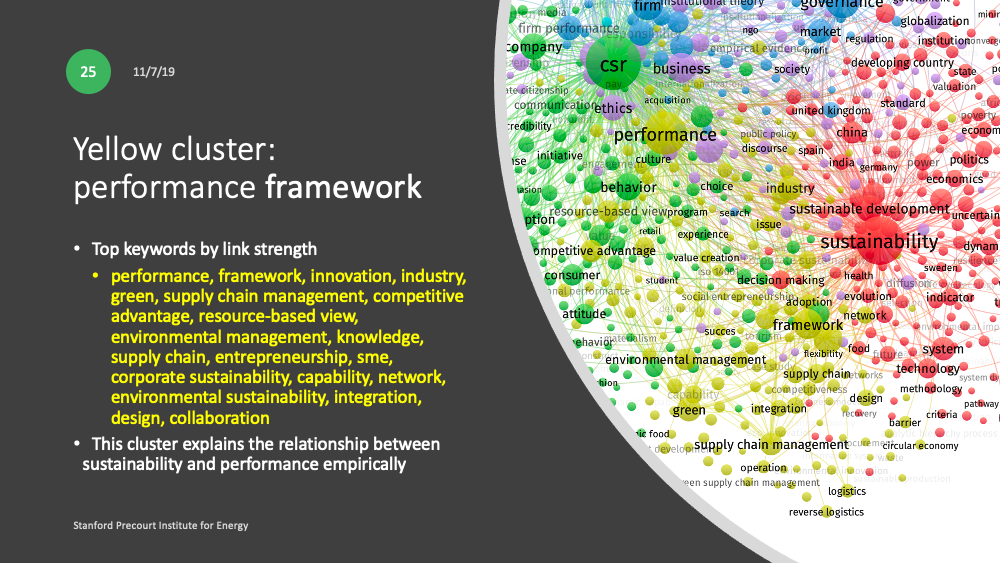

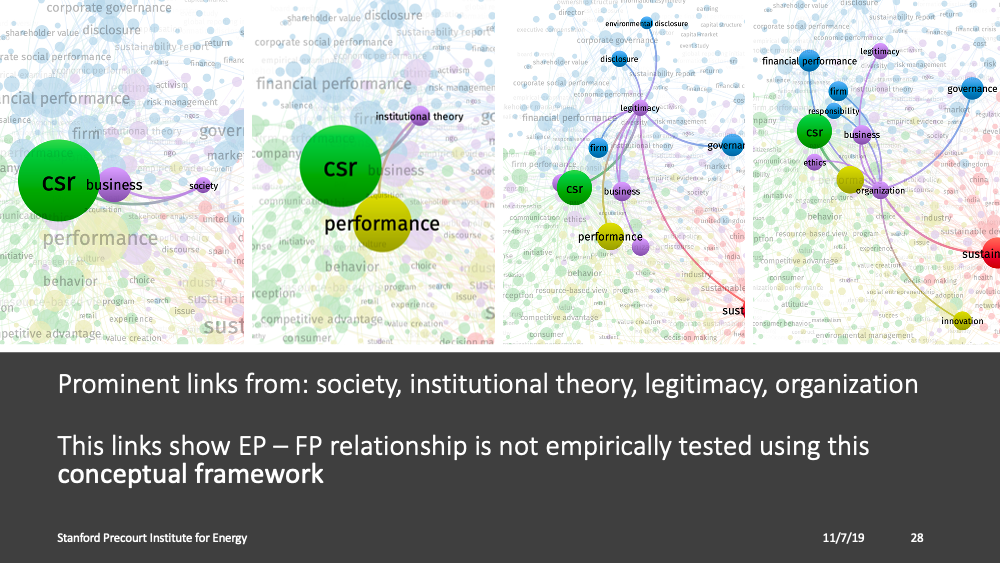

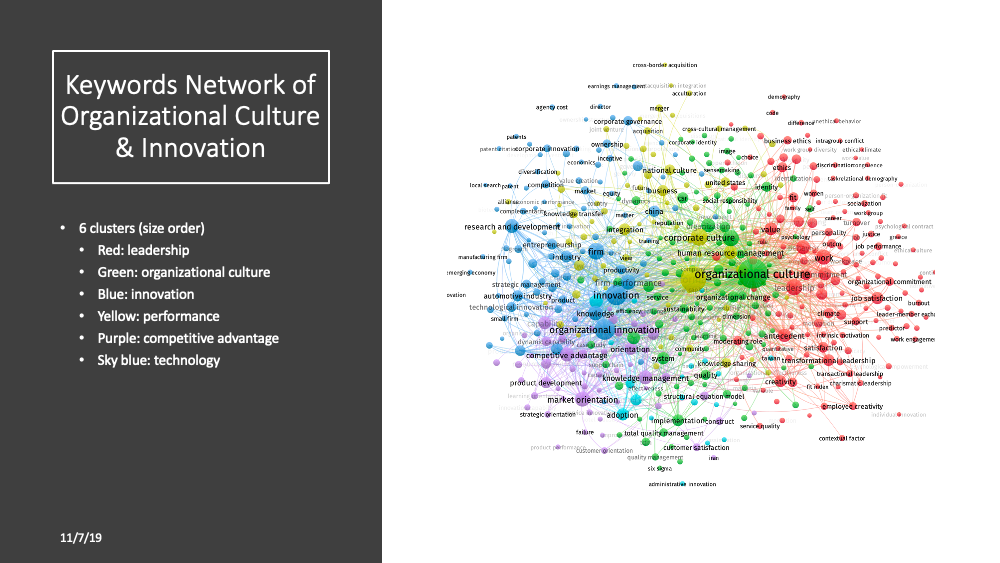

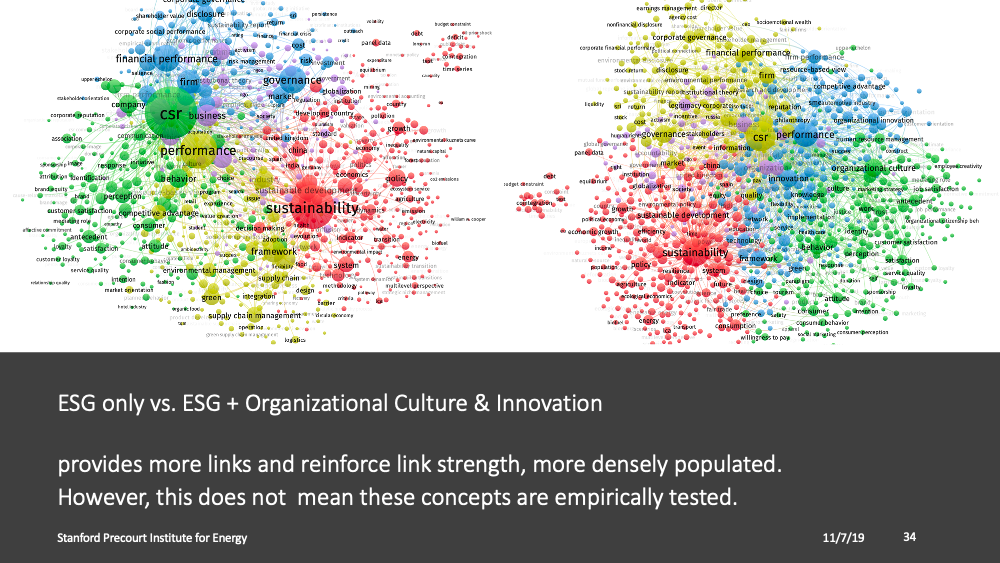

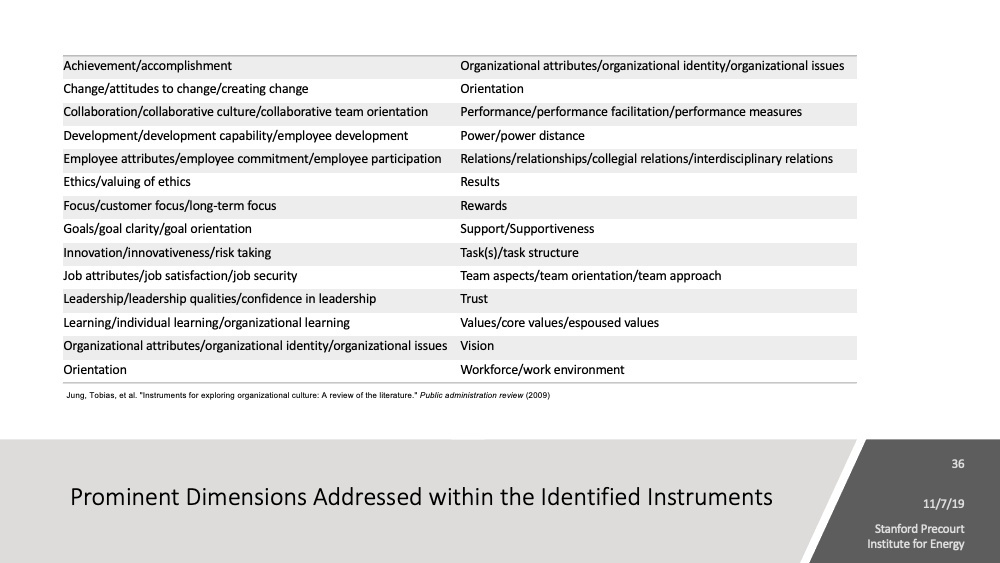

The keyword network analysis showed that ESG research is primarily focused on performance frameworks and organizational culture, with less emphasis on the empirical testing of the relationship between ESG factors and financial performance.

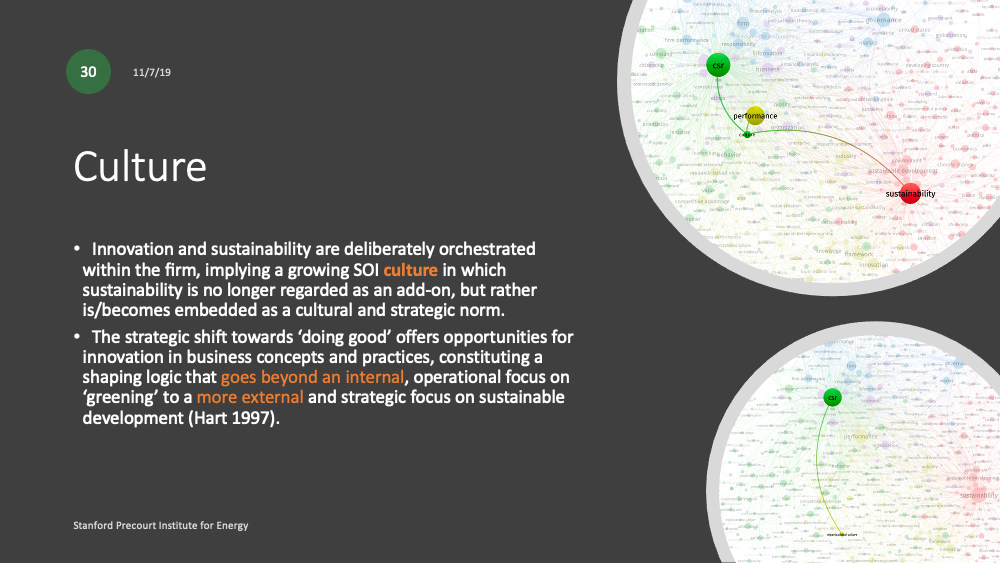

Moreover, the scientometric analysis of organizational culture and innovation suggested that integrating ESG factors with organizational culture and innovation could provide more links and reinforce link strength, potentially leading to a better understanding of the relationship between ESG, sustainability, and performance.

Conclusion#

The findings of the scientometric analysis indicate a need for further research and empirical testing of the relationship between ESG factors, organizational culture, and innovation to better understand the impact of ESG integration on organizational performance and sustainability.

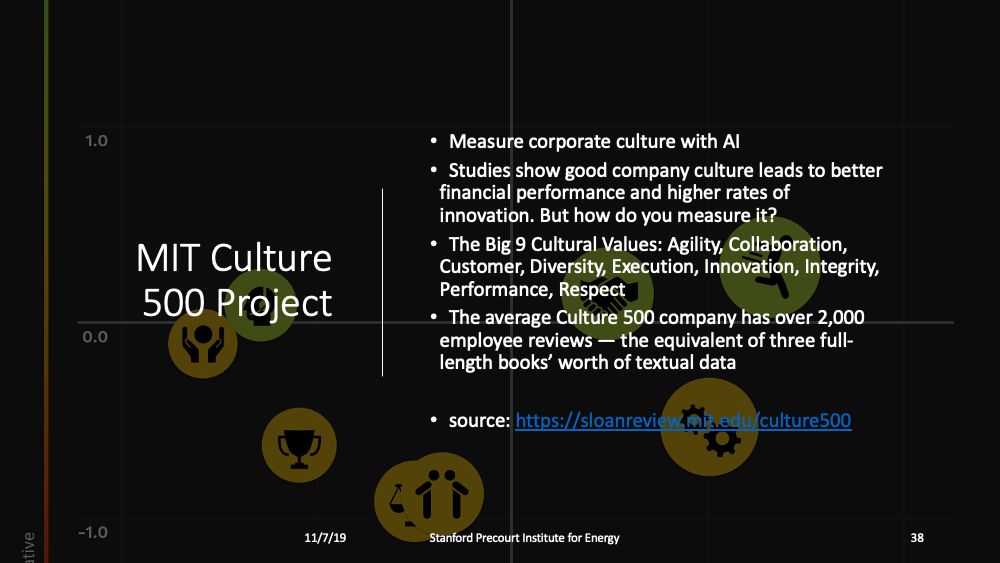

Additionally, alternative data sources, such as the MIT Culture 500 Project, which measures corporate culture using artificial intelligence, could potentially be employed to explore the role of organizational culture in ESG integration and its impact on performance and sustainability.

In conclusion, bridging the gaps in understanding ESG integration and its impact on organizational performance and sustainability could potentially unlock new opportunities for investors and organizations to incorporate ESG factors in their decision-making processes and enhance their overall sustainability and performance outcomes.